Overview

Amidst a generally positive economic backdrop, equity markets turned in a mixed performance in the second quarter. The S&P 500 (de-facto market benchmark) gained 4.3%, leaving the year-to-date return at 15.3%. More broadly, flat to negative returns were posted by almost every other broad-based index that is not disproportionately weighted by mega-cap technology stocks.

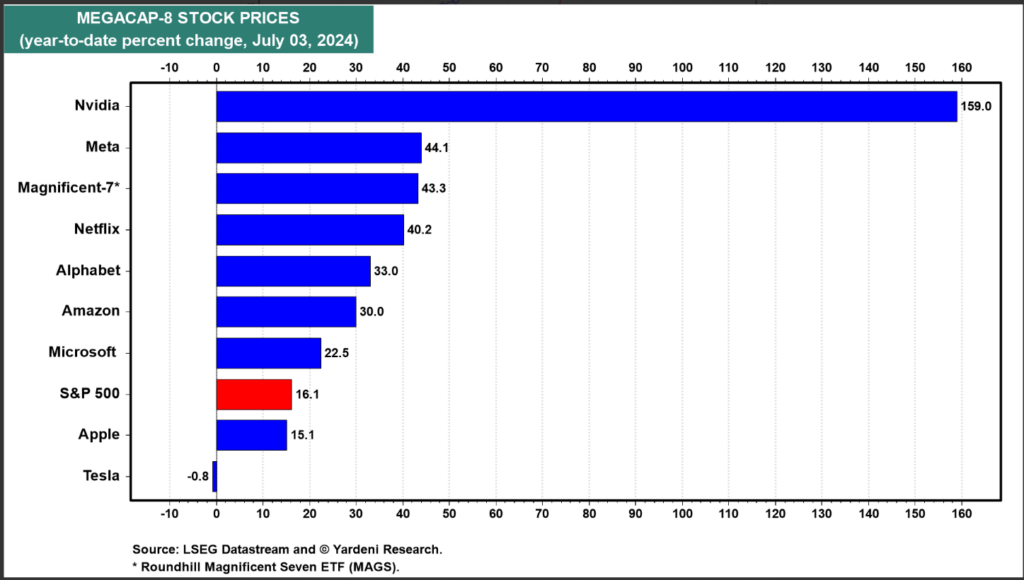

While this skewed pattern of returns was prevalent for most of last year, the current market is distinguished by the size of the performance spread and fewer stocks driving the outperformance. For reference, the year-to-date equal weighted return for the S&P 500 is only 4.3%. Even the Magnificent 7 has become more selective.

The Magnificent One

Driving returns in the quarter has been an exuberance around Artificial Intelligence (AI). This began in earnest about 18 months ago. More recent developments are creating both optimism about the potential impact on businesses and apprehension that expectations have been pushed to unsustainable levels. We’ll return to this in an expanded section in this note that addresses the Technology sector.

Macro

A brief commentary, first, on the bigger picture perspective. Most of the upward and downward swings in the market this year have been attributable to incremental news about inflation, labor markets, and Fed policy. Stocks finished last year on a high note largely because the Fed signaled the likelihood of multiple rate cuts as inflation receded. Instead, inflation has proven stickier than expected and the Fed Funds rate remains at 5.25%. Ordinarily, this absence of follow-through would not have been the recipe for higher stock prices.

Instead, stock prices found support from stronger economic fundamentals and corporate earnings results. Additionally, the anticipation of rate cuts, presumably later this year, provides a safety net; the so called “Fed Put.” Recent Fed commentary acknowledges their intent to bring interest rates down, but as long as employment data remains healthy, there is little reason for them to be in a hurry. This pause in acting on rate cuts from the last hike (July 2023) to the initial rate cut is now the second longest in modern market history.

Market volatility has been unusually low this year. Given recent all-time-highs and elevated expectations, we anticipate market swings will pick up over the balance of the year. Both bull and bear market perspectives have ample talking points to support their case. Our proprietary macro process sees the slowing impact of higher rates as not fully behind us, as well as the jobs market showing signs of slowing. There is also an abundance of worldwide geopolitical issues that can impact markets in a significant way.

This top-down analysis is very helpful in framing the near-term and mid-term risk position of markets. To that end, we are continuously reviewing portfolio asset mixes compared to equity policy targets. Comprehensive risk management is a key component of our investment and wealth management processes. This includes taking tax considerations into account when rebalancing is appropriate.

Semiconductors Shine

The growing influence of technology on our economy is reflected in its increased representation in stock market indices: 30% of the S&P 500, 50% of the S&P Growth Index, and 8% of the S&P Value Index. This expanded valuation and representation of the Tech sector is in line with the significant free cash flow that is generated by technology companies.

A year ago, most investors had little familiarity with Nvidia. Last quarter, Nvidia jockeyed with Apple and Microsoft for the title of the market’s most valuable company. Nvidia designs semiconductor chips, among other things, that power some of the most advanced AI applications, such as Chat GPT. After losing 50% of its value in 2022, Nvidia has been one of the better performing stocks and is responsible for 30% of the S&P 500’s gains this year.

Nvidia designs a different kind of computer chip – one that enhances computer speed and processing efficiency by handling multiple tasks at the same time rather than sequentially. Its dominant position at the higher end chip market is evident from its margins exceeding 75%.

How quickly competition might encroach on Nvidia’s markets in unknowable. Tech behemoths like Apple, Google, Meta, and Microsoft all have the scale, financial resources, and motivation to reduce their dependency on other chip vendors, but that transformation will take time. Legacy chip companies, such as AMD, Intel, Qualcomm, Arm Holdings, and others are also making substantial investments in this area.

There does not seem to be an imminent threat to Nvidia, but it is a matter of time before its lead over the competition diminishes. At 40 times forward earnings, it remains expensive and faces tougher comparisons against its revenue and earnings growth of the past 12 months. That said, it clearly can reach higher valuations. We will reassess adding to our small position, acknowledging that valuation concerns kept us underexposed during its impressive run.

In the past quarter, the broad semiconductor industry briefly surpassed software as the largest component in the Tech sector. Designing and manufacturing semiconductors has traditionally been considered a cyclical business – meaning that the industry’s revenues and earnings tend to rise and fall with the economy. In contrast, software companies have historically been less sensitive to economic swings, making their earnings more dependable over an economic cycle. Investors have typically placed a higher value on software companies than semiconductors because of this consistency.

This revaluation of the chip industry suggests that investors believe that the demand for chips will remain strong over an economic cycle. There is some merit to this since chips have become integral in more of the goods and services we rely on. However, it remains uncertain whether demand for even the highest-end chip can hold up during an economic downturn or when chip supply catches up with demand.

Our investment strategies have also focused on owning the companies that make the equipment used to manufacture semiconductors. Most semiconductors purchased by U.S. companies are made by Taiwan Semiconductor. They, in turn, purchase their equipment from current portfolio holdings ASML (Netherlands), KLA Corporation, and Applied Materials. ASML recently announced their most complex machine with a price tag of $380 Million (and the weight of two jumbo jets). It is able to imprint lines on a semiconductor that are 8 nanometers thick – a sheet of paper is 100 nanometers thick. Semi equipment makers have performed strongly over the past year and their earnings growth is expected to rise meaningfully in 2025.

Artificial Intelligence Exposure

Within our overall exposure to the Tech sector, our strategies hold several securities that are well positioned to capitalize on the growth of AI, particularly in the semiconductor area. One of our larger holdings is a company called Broadcom, now the 10th largest company in the S&P 500.

Originally spun out as Avago from Agilent (a Hewlett Packard spinout), it acquired Broadcom, Computer Associates, Symantec, and most recently, VMware. Its core business was making smartphone content and software for networking and cloud computing. Broadcom also operates a division that designs custom chips called ASICs (Application Specific Integrated Circuit). This segment of Broadcom’s business has ramped up its growth and profitability as a result of investments in AI.

An ASIC is a powerful chip designed for a very specific job and is often used in collaboration with other chip makers. For instance, Google has partnered with Broadcom for years, making their own chips more productive by accessing the limited focus of the ASIC to perform narrow tasks faster and with greater efficiency. This partnership positions Broadcom for significant growth given Google’s commitment to AI. Broadcom currently controls 55% – 60% of the ASIC market. Its stock has more than doubled over the past 18 months and gained over 400% since our initial purchase four years ago. As the position size has grown, we will consider when to reinvest some of these gains into other areas.

Software companies represent the largest area of tech exposure in our strategies, most of which are major beneficiaries of AI growth. Long-time positions in Microsoft, Apple, and Google have all received a lift in share prices as they have detailed their investments in AI and how this will transform their customer experience. Markets view mega-cap companies as the best positioned to achieve productivity gains from AI because they have the finances to make the necessary investments and the scale to apply them broadly.

Other software holdings across our strategies, such as Adobe, Cadence Design, Informatica, Salesforce, and Arista Networks (networking equipment) also stand to benefit from the expanding use of AI. While there has been some concern that corporate investments in AI may pressure budgets previously allocated to more traditional software, it is too early to come to this conclusion.

Outlook

In our year-end 2023 Investment Update, we highlighted the broadening of market performance across sectors that had previously lagged, driving returns in the fourth quarter. We anticipated that this trend would continue into the new year, but that has not been the case.

Our investment process is anchored by valuation and this leads us to expect a shift to broader returns in the back half of the year. We also know that expensive markets can often times last longer and go higher than expected, but ultimately the excesses are addressed.

The track record for a strong second half after a 10% or better first half gain has been 83% of the time with an average gain of 8% (going back to 1950). Analyst estimates of the market’s earnings growth is projected at 10% for the 2024 full calendar year and is expected to exceed that growth rate in 2025. Caution going into next year for reasons that the markets have simply moved too fast over the past 20 months always seems well founded, but the prospect of lower interest rates, continued Federal stimulus in 2025, and relatively full employment bodes well for more of the same. In the meantime, much focus will be on whether the Fed cuts in September or holds off for another few months. Assuming current financial conditions persist, the angst over the timing should not make much difference.